The good folks at Intellicom Analytics have been keeping a close eye on the business communications market in North America for years. The good news is that their eagerly awaited IntelliCom Market Performance Dashboard Third Quarter 2012 North American Report is out. The bad news is that it seems the hangover from the global economic downturn and changing market dynamics was a nasty one. Clearly the market could use more aspirin and a strong cup of coffee.

It is difficult to sugar coat the report’s findings. The research firm revealed that:

“The North American Business Communications market slid further in the third calendar quarter of 2012 after declining in both the first and second quarters of the year. Total manufacturer product revenues across all voice platforms, end user devices, and traditional and Unified Communications (UC) software applications declined by 3.4 percent compared to the same period a year ago.”

Intellicom noted that business climate uncertainty likely has played an even larger role than earlier in the year in driving ongoing weakness. Most problematic is that large enterprises seem to be delaying major investment decisions until after looming fiscal and tax policy issues are addressed by the U.S. government and hence they can gauge with greater clarity the direction of other macroeconomic drivers for 2013 and beyond.

These declines were not universally experienced across all major providers during the period. Cisco, Avaya, and NEC posted year-over-year declines in a narrow single-digit range. Mitel and ShoreTel, however, enjoyed fairly strong growth. Just outside of the top five, Toshiba also posted a moderate gain.

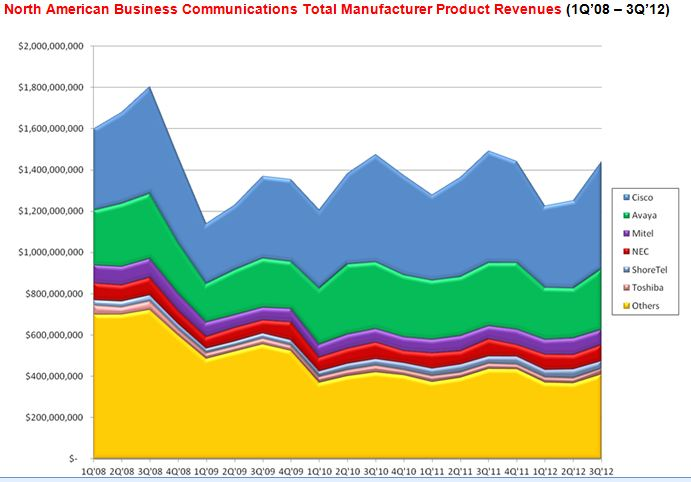

Intellicom has produced a historical look at the industry leaders dating back to the start of the recession.

North American Business Communications Total Manufacturer Product Revenue (1Q’08 – 3Q’12)

Image via IntelliCom Market Performance Dashboard, November 2012

Interestingly, this market slippage comes at a time that is a crossroads for the industry:

- The installed base of business communications systems in NA has never been older

- The need to move from TDM to IP to bring enterprises firmly into the Internet Age has never been more urgent as things like VoIP, presence, unified communications (UC), mobility and social media integration become competitive necessities.

- Open Source solutions are hurting sales and margins

- The cloud is raining on the premises-based parade

A few of the key competitive highlights from the report are noteworthy:

Cisco remains number one but in the Q3 experienced a four percent decline in total manufacturer product revenue compared to the same period a year ago, and Q3 in-region revenue declines were steeper than the corresponding overall market declines.

The report adds that Cisco’s share of total manufacturer product revenue fell slightly compared to Q3 of 2011. The authors believe some of this is likely attributable to installed base upgrade initiatives around the CUWL licensing offers having largely run their course, as evidenced by the 52 percent decline in UC client shipments compared to Q3 of last year. And, the authors note that Cisco’s reliance on large enterprises also makes it susceptible to the problematic business climate.

Avaya retained the number two position. Like Cisco, total manufacturer product revenue declined by roughly four percent compared to the same period a year ago. This put Avaya just below the overall industry rate, minimizing revenue share loss as a result.

The report found that this performance was not universal across the region. A spike in shipments of call control and UC client solutions in Canada offset flat to declining volumes in the U.S. Specifically, Avaya’s “Triple 7” migration incentive program was credited with upgrading a large number of Nortel CS 1000 customers to Avaya Aura in Canada. The new, more scalable 8.1 release of IP Office also played a role in bolstering shipments in the SMB range.

NEC swapped places with Mitel and regained third place during the third quarter. Although down 6.5 pecent compared to last year and losing a small margin of share as a result, NEC still benefited from its fiscal calendar which tends to boost sales in calendar Q1 and Q3.

NEC noted strong shipments in the education and healthcare verticals. Although established offers still command a high proportion of NEC’s results, the company’s recently-launched UNIVERGE 3C solution and related UCaaS offers also built from the Sphere architecture are expected to grow in importance in future quarters.

Mitel was number four but experienced the strongest growth of any of the major providers. Total manufacturer product revenue was up by more than 16 percent for the period. This was partly driven by Q3 of 2011 being a relatively light quarter, the only period of negative North American growth for Mitel in all of calendar year 2011. However, given that both Q1 and Q2 of this year grew at just under 10 percent, the performance year-to-date has been solid. The shift to a direct-touch sales model in the U.S. market has played a key role in revitalizing Mitel’s channel over the past year, while it’s TotalSolution managed service has historically done well during periods of economic uncertainty.

ShoreTel at number five outperformed the market for the second consecutive quarter in Q3. Total manufacturer product revenue for the period rose by nearly nine percent on an annual basis. These results are based on ShoreTel’s traditional portfolio of premise-based solutions and do not incorporate any revenue from the company’s new cloud division.

Although ShoreTel has moved quickly to rebrand the offerings of its M5 Networks acquisition as ShoreTel Sky and also established interoperability with the ShoreTel (Agito Networks-based) Mobility offers, the authors state that significant development will be necessary to fully implement the hybrid delivery models that this merger may ultimately make possible.

What’s it all about?

As a former analyst of this market myself, what struck me was not the relative positioning of the players, but rather the symmetry of the overall market movement. My own suspicion, based on the factors driving change in the market is that next year at this time the snapshot may look quite a bit different. Assuming the U.S. Congress does not drive the economy off of the “fiscal cliff,” it is hard to imagine that enterprises of all sizes are not going to give serious consideration to either migrating to IP or being fork lifted to it. The trends in the Session Boarder Controller (SBC), SIP trunking, cloud, hybrid solutions, and Open Source markets are all pointing toward continued downward pressure on traditional premises-based solutions. And, lest we forget, a whole lot of Microsoft Lync licenses are just waiting to be used, and Microsoft has made it very clear it intends to leverage that base.

This does not mean the PBX is dead. What it does mean is that traditional vendors are going to have to adroitly cover all the possibilities for connecting people, their devices and applications. The world is going to be about ecosystems, and how we analysts capture the granularity of a world where a single user can have six or more personal devices, access via multiple soft phones, call from browsers, etc., is going to make the calculation of vendor shares a wonderful and fascinating challenge.

Despite the gloomy news for the market, the good news is that the market leaders above all are aware of the significant challenges they face and that time is of the essence. It is likely that there will come a time when a long-term view of this market is the three month increments of the Intellicom Dashboard reports. The reason is while vendor market share may not be moving fast, the market itself is moving fast and the pace is accelerating.

Edited by

Brooke Neuman