Coming after a day that saw the U.S. markets stumble badly on a continued drum roll of disappointing earnings from major corporations the past few weeks, including tech stars IBM and Microsoft, AT&T gave investors a pleasant surprise with an early morning release of its earnings that beat the Street consensus view.

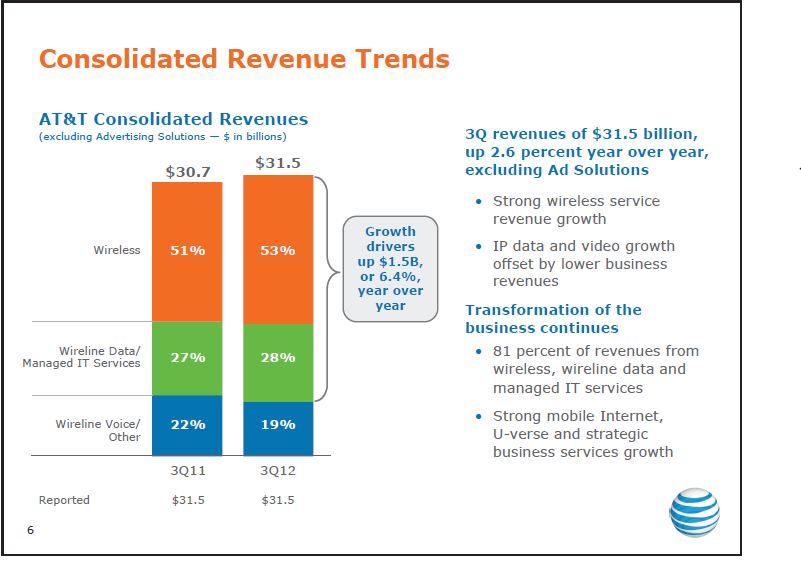

Analysts had been expected $31.57 billion in revenue and 60 cents EPS, while the company turned in Q3 results on target at $31.5 billion and 62 EPS on a non-GAAP basis.

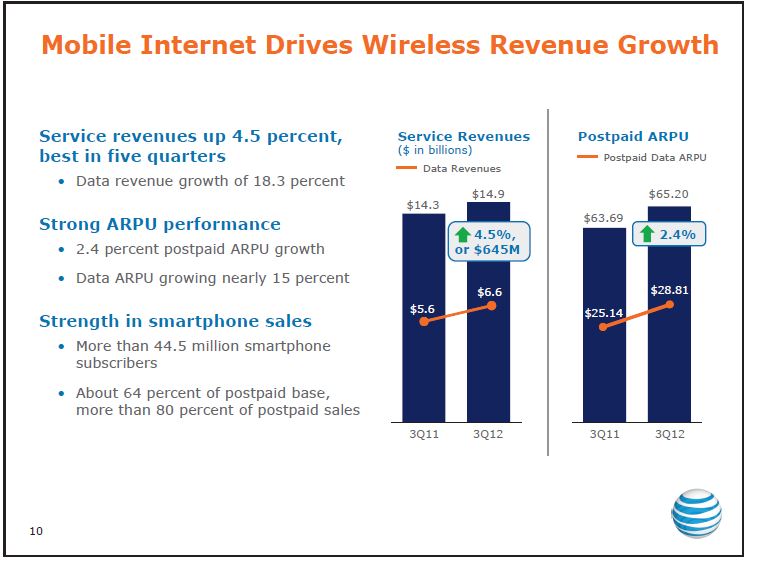

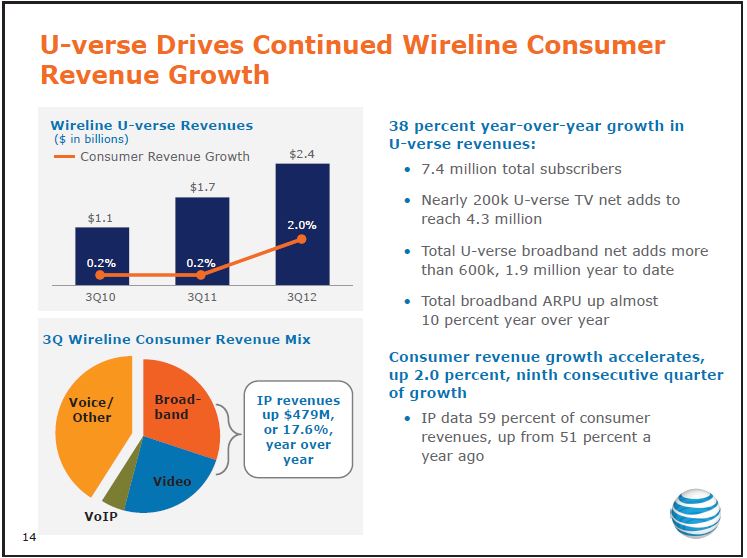

As might be expected, Randall Stephenson, AT&T chairman and chief executive officer was enthusiastic in stating, “We had another impressive quarter with strong earnings growth, record cash flows and solid returns to shareholders through dividends and share buybacks…In wireless, we had another excellent smartphone quarter, penetration of usage-based mobile data plans continues to climb, and our 4G LTE network build is ahead of schedule. And in wireline, our IP network continues to deliver strong gains in U-verse high speed Internet connections, which helped drive an almost 10 percent increase in broadband data ARPU…Our strong performance allows us to increase our free cash flow guidance to $18 billion or higher this year, exceeding our previous outlook by $2 billion.”

Rather than provide the customary list of numbers, I would like to share with you what AT&T shared with the financial analysts, since the visualization helps and in this case is basically self-explanatory in terms of understanding the results.

This is a case as John Stephens, senior executive vice president and CFO said on the call, “What’s not to like!?”

As will be seen below, the company’s focus on its leading growth drivers, residential triple play network services via U-verse and wireless data, even in a problematic economy are not just growing, but are positioned for further improvement.

The pullout on the growth of the growth drivers tells it all.

Given what other service providers are showing in the wireless business where ARPU is on the decline, the growth in ARPU, along with the reduction in churn and shift of users to the Mobile Share usage-based data plans, hopefully is a good sign not just for AT&T but others. As Ralph de la Vega, President and CEO, AT&T Mobility, stated on the call (and in a video explaining the results), “Taking the massive data growth we are building new services on top of it… These are services will differentiate us from the competition.”

He also noted that the change in the mix of device types, the move to usage plans, the coming wave of tablets that will make use of those plans, and the ability to leverage those smartphones for new services that will be rolled out for home automation and enhanced experience in automobiles are reasons for what can only be described as bullish optimism.

The below can be summed up in two words: “Cable Beware!” AT&T is right to point out the significance of its ability to continue to attract business for U-verse since it likely is coming out of the market shares of cable companies and the sitcom providers. While they have not gone to a quadruple plan like Verizon’s collaboration with Time Warner and Cox, the value prop for triple plan is proving compelling despite customer caution about their discretionary spending.

On other fronts, the record cash flow, resolution of pension funding challenges, stock repurchases, exceeding targets for their buildout of 4G LTE, debt reduction, margin improvements almost across the board and a watchful eye on expenses, all bode well.

In fact, the only dark clouds on the horizon appeared to be a shortage of iPhone5s and continued economic uncertainty in business services. On the former, de la Vega said, “what we are seeing is typical of iPhone launches.” He said such launches always see a burst of orders that cannot be immediately fulfilled and that AT&T is “comfortable” with the supply outlook as things die down.

Interestingly, the fact that most of the iPhone5 orders that were filled went to existing customers. From a financial perspective this means that Q3 earnings were actually better than expected in terms of profitability, as new customer acquisitions is much higher than handling new phone activations and subscription changes for existing ones. Hence, while total activations were not as robust as they could be, reality is the ones that were handled were very profitable.

Plus, those customers tend to be more loyal and are gobbling up the higher end of the Mobile Share plans, boosting ARPU and laying the foundation for those tablets sales during the holiday season, as well as creating the platform for further profitable growth.

On the latter, AT&T earnings obviously are gated by the global economic slowdown as well as uncertainties about the U.S. presidential election, the sovereign debt crises spill-over impacts and the sequestration cliff-hanger that the U.S. Congress must resolve.

Going back to the Stephens remark, there is very little here that is not to like. In fact, the executives concluded their call by noting that their guidance for the rest of the year is “on track to meet or exceed full-year guidance. “

A year ago, the company was significantly challenged, the T-Mobile merger was on the ropes, people wondered about AT&T’s ability to keep wireless customers because of a perceived problem catching up in LTE deployment, and there were questions regarding the company’s commitment to U-verse investments.

In short, it would have been hard to believe their balance sheet and prospects in the areas that matter would be so strong.

This was a much-needed shot in the arm for Wall Street, and as noted above, hopefully is a harbinger of better days ahead for the entire service provider sector. It will be interesting to see if the momentum can as promised be sustained over the next quarter.

Edited by

Braden Becker