Over the top voice and messaging apps are brutal developments for mobile and fixed network service providers because “free” is a tough price to beat. And at some level, access providers (both mobile and fixed) have to worry that something like that could grow in the high speed access business.

“Free” public Wi-Fi hotspots are one example. FreedomPop provides another example. But price disruption can happen several ways in a market. Firms, such as Google, can dramatically change end user expectations about the nature of access products.

When Google sells symmetrical 1-Gbps for about $70 a month that creates new expectations on the part of consumers about what the “normal” value-price relationship is for fixed high speed access.

In addition to “free,” “very low cost” and “much higher value” propositions can disrupt buyer expectations in ways that force competitors to react. That is precisely what Google intends by offering 1-Gbps service in Kansas City, Mo. and Kansas City, Kan.

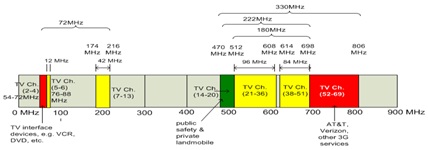

Similar challenges possibly could occur if widespread spectrum sharing were to be authorized, or when “white spaces” spectrum is cleared for commercial use in either the United States or United Kingdom.

Even market entry by one or more new mobile providers (Dish Network, Globalstar, Lightsquared) could add to the pressure, creating an opportunity for more disruptive pricing, in part by increasing supply. Moreover, more providers might try to compete with a “data only” approach that minimizes overhead and operating costs to dramatically lower the retail pricing for mobile broadband.

Nor is the only or even primary danger posed by other service providers. In fact, the most dangerous new potential competitors would seem to be firms that have huge installed customer bases, alternate revenue models, recognizable brand names and plenty of cash. Apple, Google, Microsoft, Amazon, and possibly Facebook come to mind.

In fact, Google and Microsoft are rumored to be actively exploring how to use white spaces spectrum in the United Kingdom market, reportedly to offer free Internet access.

As always, it always is dangerous for a firm to compete with a well-funded challenger intent upon giving away the product that firm sells. The angles are simple enough. Google might provide free Wi-Fi style access for all devices running Android, while Microsoft might try and do the same for users of its devices.

Free is a tough price to compete against.

Regulators in the United States and United Kingdom have been looking at how to enable use of “white spaces” spectrum for at least five years, initially spurred by device and application providers (Microsoft, Google and others) interested in how the spectrum could support in-home content distribution, communication hot spots or rural broadband.

In the U.K. market, stakeholders tend to believe the promising uses of such spectrum are rural broadband, hot spots, in-home broadband and in-home content distribution, Ofcom says.

A sort of interesting twist is that, for reasons of frequency (former TV spectrum), white spaces networks potentially could use a single tower to provide service across a wide area (a whole town or city). That would mean a service provider would not need to build a cellular style network with many towers, but possibly transmit only from a single location to cover a whole town or even city.

Others think unlicensed approaches could support new backhaul links, potentially providing new options for higher bandwidth backhaul at lower costs than is possible at the moment.

Others believe there could be applications in the machine to machine communications business.

In any market where regulators decide to commercialize white spaces systems, it may matter quite a lot how the spectrum is licensed. In other words, unlicensed access might produce one set of contestants, while licensed spectrum access might tend to produce a different set of contestants. Generally speaking, unlicensed approaches are seen to provide a better avenue for new entrants, particularly smaller and independent providers.

Edited by

Brooke Neuman