Over time, virtually every segment of the communications industry consolidates, with a few big market leaders emerging. That happens despite regulator efforts to limit “bigness” or policies intended to spur competition. Recent spectrum auctions in the Netherlands illustrate at least part of that process.

As you might expect, most of the new 4G spectrum that recently was won in the Netherlands spectrum auction was won by the biggest mobile service providers in the Netherlands. That happened despite restrictions on how much new spectrum the leading mobile service providers could acquire.

In the auction, two spectrum blocks in the 800 megahertz band and one in the 900 MHz band will be reserved for new entrants. That was the provision that allowed Swedish mobile operator Tele-2 to secure 20 megahertz of spectrum in the 800 MHz band.

Vodafone and KPN spent the most, with T-Mobile spending about 66 percent of what Vodafone and KPN invested. Tele-2 spent about 12 percent of what Vodafone and KPN spent, but also acquired a modest chunk of the new spectrum. Still, the “pro-competition” rules will not likely change the structure of the Netherlands market.

That could happen as a result of combat between the top-three providers. But the spectrum set-aside simply doesn’t provide enough spectrum for Tele-2 to take too much share.

Virtually everywhere, communications remains a scale game, whether conducted on a “virtual” (leased network) or “facilities” basis. From time to time, new regulatory policies or entrants can cause ripples, but few such actions wind up creating big waves.

In fact, though some criticize “deregulatory” actions taken in the U.S. market in the recent past, such as ending mandatory access rules and significant discounts for that access, it isn’t clear such policies actually have harmed competition, in a broad sense (some will disagree, of course).

Many observers complain about the dominance of cable companies and telcos in the fixed network high-speed access market, but a new analysis by Ofcom, the United Kingdom communications regulator, suggest the United States and Canada have the least concentrated markets among 13 examined by Ofcom.

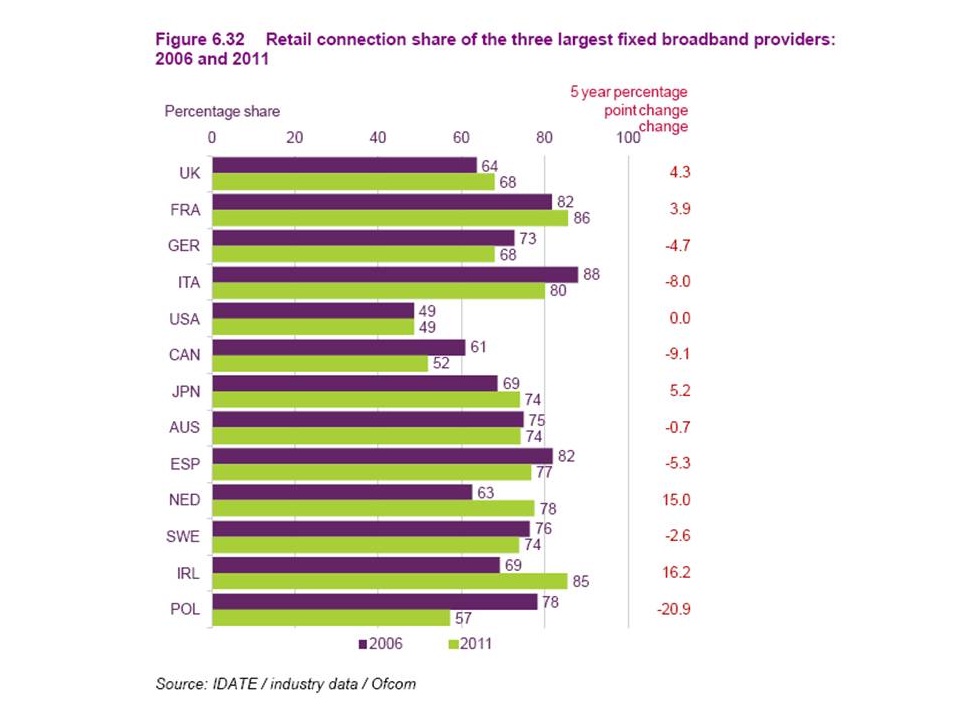

When the combined retail customer market share of the three largest broadband providers in each country is used as a measure of market concentration, and across the 13 countries for which figures are available, the average share of the largest three providers increased from 64.1 percent to 65.2 percent in 2011.

In the five years to 2011, the change in the combined connection share of the three largest providers in each country ranged from a 20.9 percentage point fall in Poland to a 16.2 percentage point increase in Ireland.

But over that same period U.S. concentration did not grow at all, and Canadian concentration actually dropped nine percentage points.

The point is that, over the long term, all communications markets will wind up being dominated by just a few providers. Though it is a reasonable concern of policy makers and regulators to prevent predatory business behavior by those market leaders, there seems to be very little long term effect from actions to induce more competition.

Of course, political rationality always is distinct from economic reality. Politicians or regulators will always “look good” by taking some measures to “promote competition.” And competition is a good thing. But pro-competitive rules seem never to result in changing market structure, because competition itself leads to concentration.

Edited by

Brooke Neuman