Austin Texas may be “weird”, and places like Boulder, CO “cool” when it comes to being incubators and accelerators of technology start-ups in the U.S. However, if you are a privately-held tech company looking for an exit strategy, the latest report from PrivCo, a research outfit that tracks such things, found that in 2012 Silicon Valley, Silicon Alley (New York City) and Boston are still the places to cash in or cash out depending upon how you view the benefits of a financial “event.”

Let’s make a deal

The top three areas are the usual suspects, and the deal flow is impressive. The rankings were as follows for the top three.

- Silicon Valley: 226 deals worth $21.5B

- Silicon Alley: 100 deals worth $8.3B

- Boston-Cambridge: 62 deals worth $1.7B

Note: BTW. Austin may want to stay weird but it did come in fourth and actually beats out Boston in another respected ranking.

As noted in a statement in Crains New York, Sam Hamadeh, CEO of PrivCo said, “"It's clearly a testament New York City has arrived, and that we can create private technology companies worth being acquired."

He added that New York companies' average deal value of $83 million was a dramatic step up from previous years, when the average was in the $30 million to $40 million range. He also noted that last year was the most active tech M&A market since PrivCo began tracking the sector in 2009, with 2,357 deals and estimated deal volume of $112 billion. The dollar figure marked a 22 percent spike from the prior year and was almost double the $64 billion in deals in 2009.

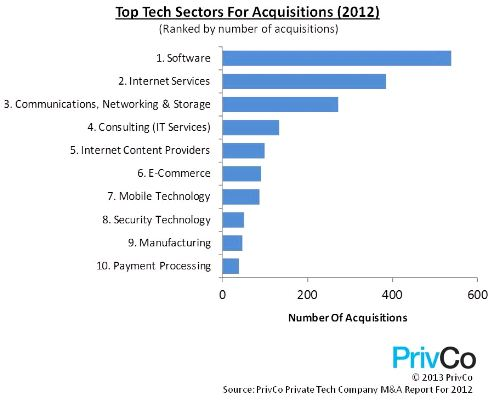

The PrivCo report is chock full of goodies. In fact, there is terrific information about the top acquirers of private companies in tech (no surprise FaceBook and Google rank number one and two), the top private equity companies, banks and lawyers involved in the transactions, and a lot more. Just as a teaser, the graphic below is certainly one to ponder.

If nothing else it is an interesting indicator of where the money is flowing at the moment. The surprise here is that given the number of mobile and security firms playing bridesmaids looking for a suitor that there was not more activity. I am not sure what to read into that except to say as they do in baseball, “wait until next year!”

In the meantime, the message here seems to be if you are looking for action and don’t live in one of the areas PrivCo cites as hotbeds of M&A, you can always move. Can’t wait to see how the lists change at this time next year.

Edited by

Brooke Neuman