What are mobile service providers (MSP) supposed to do when the addressable market for new subscribers reaches the saturation point? This is a question vexing many MSPs in the developed world.

For answers and insights about the challenges and actions in the U.S., a great place to turn is the just published PwC U.S. annual wireless industry report, which looks at the financial and operational reporting policies and practices of the largest MSPs in the U.S. – titled: “Real time. The growing demand for data. 2012 North American wireless industry survey.”

The survey finds that the U.S. has possibly reached a level where most of the addressable market has a mobile device and service, and MSPs are on the hunt for new revenue as demand for data services explodes, as the adoption of smartphones and tablets continues unabated, and as the nature of network traffic becomes more video and “immersive experience” focused.

“The maturing mobile industry is at an inflection point with price and value conscious subscribers consuming more data services requiring continuous and significant network investments from operators,” said Pierre-Alain Sur, PwC’s global communications industry leader. “Carriers need to find the right balance of finding innovative ways to retain and attract subscribers, creating shareholder value, while investing significantly in their networks. As a result, many are turning to new growth areas such as multi-device data plans, machine-to-machine (M2M) subscriptions and greater customization of service plans for new revenue sources.”

The numbers are revealing

According to the PwC survey:

- The average tablet connections grew nearly 43 percent year-over-year due to higher demand for mobility from businesses and consumers, better network connectivity and higher data demand.

- Smartphone sales to postpaid customers represented 60 percent of new device sales, up 46 percent from the 2011 survey, and accounted for 70 percent of postpaid upgrades, up 40 percent from the 2011 survey.

- Android was the most widely used operating system as of June 30, 2012 and comprised an average of 81 percent of prepaid subscribers and 55 percent of postpaid subscribers.

- Prepaid services remained consistent representing an average of 25 percent of total service revenues. Respondents attributed this to the combination of a maturing market, mobile subscriber penetration exceeding 100 percent and rebounding recessionary consumer purchasing behaviors.

- Mobile voice usage continues to decline with the average minutes of use (MOU) per postpaid subscriber decreasing from 720 MOU per month to 673 MOU per month.

What are MSPs doing in response to these trends?

Not surprisingly, PwC found that U.S. MSPs are accelerating the transition to 4G technology to accommodate the demand for data services. Getting into the operational weeds, 11 of the 13 responding carriers had their own cell sites using 4G. This is relative to only five carriers responding to the 2011 survey. Plus, on average, 65 percent of carriers’ cell sites used 4G technology, compared with 46 percent in the 2011 survey, and 60 percent of the subscriber base was covered by 4G technologies, compared with 53 percent in the 2011 survey.

In one of the more interesting findings from the survey, eight of the 12 responding carriers have plans for, or are currently in the process of decommissioning network assets. Most of this consists of cell site and switching and radio equipment in the 2.5GHz band.

“Driven by the complexity and cost of maintaining multiple technologies, more carriers are preparing to decommission their older networks as more subscribers continue to upgrade more quickly to new devices,” said Shara Slattery, PwC partner and managing editor of the North American wireless industry survey. “Pressured to make the most of existing spectrum, network operators and equipment vendors are considering new approaches to network deployment including focusing on small cells and finding better ways to make valuable legacy assets be available for reuse.”

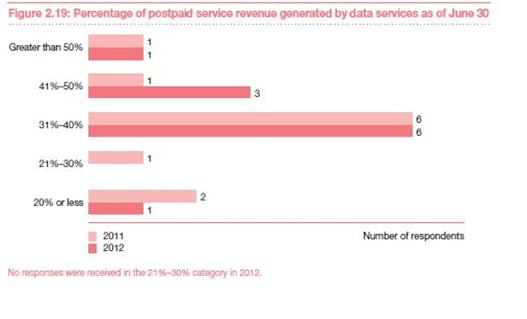

For those of you who like to crunch the numbers, the PwC report is a must-have download. The 176-page piece goes into incredible detail, with lots of charts, such as the example below (number on the far right represents number of respondents in the category).

Source: PwC

And while no MSP company names are revealed, the granularity of the data is interesting for evaluating not just industry trends, but comparative performance.

Because of the challenges of obtaining accurate data and PwC’s efforts to get cooperation from the major MSPs for this voluntary report, the numbers reflect activities up to June 30, 2012. Given how fast the industry is moving, what can be said is that many if not most of the trends discussed are accelerating.

In short, the device explosion and associated storm for data demand on those devices is pushing MSPs to increase their 4G deployments, retire equipment no longer suited for a data-centric world where voice continues to decline, seek solutions such as small cell deployments to solve the bandwidth crunch and provide the platform for growth by enabling new markets.

The good news for those of us in the U.S. is that our 4G phones increasingly are going to be connected to 4G networks when we are out and about. How fast the industry moves on this front is something to pay attention to as competition and industry restructuring heats up.

Edited by

Braden Becker