Billionaire investor Carl Icahn certainly shows no signs of slowing down his activist investor ways. At the moment, the nearing 80-year-old seems to be focused on big tech names, with Apple and eBay being his latest (pardon the expression) targets. Let’s just say he has gotten a frosty reception from both that is worthy of the Polar Vortex now invading the U.S. If nothing else, at an age when most of us envision retirement you have to admire his passion along with his moxie.

With the caveat that I always give to such things—that I am not a certified financial analyst, and do not play one on the Internet or TV—it is useful and even entertaining to see what Carl hath wrought.

Carl wants eBay to “Pay Pal!”

eBay is coming off an impressive earnings report. Revenues increased 19 percent to $1.8 billion for the quarter, and they gained 5.2 million accounts. The latter gave them a total by year end 2013 accounts which is a 16 percent increase over 2012. In short, they not only are doing well, but are directionally correct in terms of growth. That said, as is his modus operandi, Ichan—who by his own admission owns a rather small 0.82 percent of eBay’s stock, which makes him far from the largest shareholder—feels management is not maximizing the company’s value for shareholders and he is grumpy about it. Indeed, he has suggested to eBay that they divest their lucrative Pay Pal subsidiary and share the resulting windfall with shareholders, and he is demanding seats on the eBay board of trustees. While I am not sure which ranks higher on the “you’ve got gall” scale, this is a tried and true attempt at what many perceive as a form of extortion, and others looking for a faster buck see like to encourage.

Icahn always positions himself on the side of all shareholders in his machinations. He even usually uses the term “long-term” when describing his and his fellow activists who are typically institutional investors. I have always wondered just how long-term this is in a world where computer trading is an increasing large portion of all transactions on global exchanges. The nice thing about Ichan’s maneuvers is that when he does not get his way and eliminates his position in target companies he ends up with “plausible deniability” regarding his intentions.

However, I digress. Carl asked and eBay responded in the last few days. As cited in a Forbes article on the subject, eBay stated that while it loves hearing from all of its shareholders, the eBay board has, “explored in depth a spinoff or separation of PayPal.” And, they concluded that, “payment is part of commerce, and as part of eBay, PayPal drives commerce innovation in payments at global scale, creating value for consumers, merchants and shareholders.” In short, thank you but no thank you, Mr. Icahn.

Apple feels it is not rotten to the core

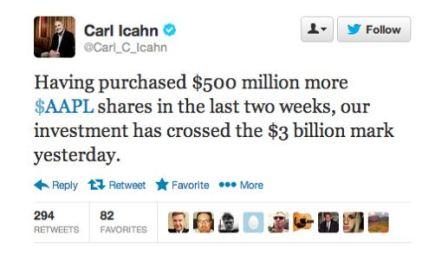

The Icahn run at Apple has taken on a more public tone. As with seemingly almost everything these days, it started with a Tweet.

It continued with continued with an open letter to Apple shareholders (which the good folks at Business Insider have reproduced in its entirety) excoriating Apple’s board and CEO Tim Cook for not enlarging a stock repurchase plan to give shareholders more of Apple’s estimated $147 billion cash hoard.

Just to give you a flavor of the rather lengthy and very self-congratulatory letter, here is my favorite which is the closer after Icahn’s recitation of why he holds so much Apple stock and has purchase even more.

In this letter, we have above summarized why we believe Apple is undervalued in order to express how ridiculous it seems to us for Apple to horde so much cash rather than repurchase stock (and thereby use that cash to make a larger investment in itself for the benefit of all of the company’s shareholders). In its statement in opposition to our proposal, the company claims that “the Board and management team have demonstrated a strong commitment to returning capital to shareholders” and we believe that is true, but we also believe that commitment is not strong enough given the unique degree to which the company is both undervalued and overcapitalized. Furthermore, it is important to note that a share repurchase is not simply an act of “returning capital to shareholders” since it is also the company effectively making an investment in itself. To us, as long term investors, this is an important difference: a dividend is a pure return of capital while a share repurchase is the company making an investment in itself by buying shares in the market at the current price, which we believe to be undervalued, from shareholders willing to sell at that price for the benefit of shareholders who choose to remain investors for the longer term. And we are long term investors. It should be noted that no one on the Board seems to be an expert in the world of investment management.

All I can say is wow!

Like eBay, Apple’s board has not been receptive to the entreaties of Mr. Icahn as to how best to spend the company’s money. And, while Mr. Icahn is not alone in feeling that the company is undervalued, he certainly has a flair for making his voice heard if not listened to.

I don’t know about you but on a cold day in January all of this makes me want to sing along with the Zero Mostel version of “If I were a Rich Man” from the hit show and movie Fiddler on the Roof.

I do not hold is my modest portfolio either eBay or Apple stock at the moment. If I did, however, my attitude would not be that different. The value of stocks are what the market determines them to be. Like real estate, you can hope it is worth more than you paid for it, but at the end of the say value is what somebody is willing to pay. I and most people in the world are not in a position to look at things we value and try to influence an increase in value and accelerate a return on our investment. That is the game people like Carl Icahn play whether we like it or not. As somebody who likes to play games, but does not like to gamble, I wish I was a wealthy man so I could be like Carl.