In a follow-up to our recent article on worldwide smartphone sales for Q3 2012, IDC has just weighed in on the issue of Q3 2012 smartphone sales, and has provided its own numbers and results. Admittedly, they are not much different than those from ABI Research and Juniper Research that we reported earlier, but they do provide additional perspective.

As IDC notes in its “Worldwide Quarterly Mobile Phone Tracker” report, a report that the company has published dating back to 2004, the worldwide mobile phone market grew 2.4 percent year over year in Q3 2012, driven by Samsung and Apple – as Juniper and ABI also point out.

According to the IDC report, mobile device vendors shipped 444.5 million total mobile phones in Q3 2012 compared to 434.1 million devices in Q3 2011.

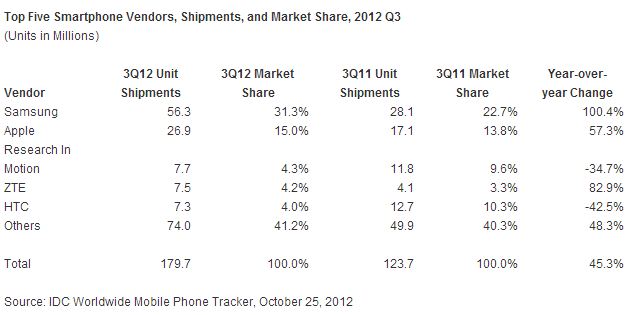

Specifically in the smartphone market, IDC notes that the device makers shipped 179.7 million units in Q3 2012 compared to 123.7 million units in Q3 2011. This represents year-over-year growth of 45.3 percent, a number very slightly above IDC's forecast of 45.2 percent for the quarter.

The IDC report reflects IDC’s Top 5 list, as indicated purely by mobile units shipped per quarter. Aside from what anyone can now predict with a high degree of confidence – namely that Samsung and Apple are going to be one and two on the list, respectively. The rest may not be quite so easy to place.

Interestingly, China-based ZTE – which has traditionally found its largest market in China, finished among the top 5 smartphone vendors globally thanks to continued international diversification efforts last quarter – especially in the United States. ZTE continues to play primarily on the low end of the smartphone field, but as Samsung has also figured out, there’s a great deal of gold to be mined in this neck of the woods.

That puts ZTE at number four on IDC’s Top Five list – clearly a substantial improvement in ZTE’s fortunes.

HTC, who’s rapid decline since 2010 was noted by both Juniper and ABI, manages to hold on to a 5th place position, though HTC’s position may erode and HTC may find itself of the charts entirely the next time IDC puts its report out. Although year-over-year growth in the Asia/Pacific region has helped HTC’s numbers, that growth has been significantly offset by a large downturn in the U.S.

HTC’s new Windows 8-based 8X and 8S models need to drive a large share of new sales for HTC to remain a top five player. It is going to be a tough sell for HTC.

The chart below shows IDC’s top five list, along with a variety of useful statistics.

What Goes Around Comes Around?

The key thing to note in the chart above is the new and notable absence of Nokia from the list. Nokia continues to deliver dismal smartphone numbers, and managed to move only 6.3 million phones in Q3 2012. Meanwhile, Research in Motion, even as it continues its own downward spiral, managed to sell enough “old” devices to stay on the chart, maintaining a distant third place position – at least for now. RIM will miss the entire holiday buying season, which will badly skew its numbers for Q4 2012 and possibly send it off the list.

Or it may end up almost giving its devices away, which may keep it on the list but won’t generate any revenue.

Both companies are caught in webs of problems of their own doing, with Nokia finding itself in the dubious position of having a key phone in its lineup – the Lumia 820 – that cannot be updated to Windows 8 while still not having its Lumia 920 out in the market for sale.

RIM of course has numerous documented issues we won’t rehash here.

That said, both Nokia and RIM may yet recover and deliver turn-arounds. Nokia’s Lumia 920 is an excellent smartphone and may yet provide a comeback for Nokia. If RIM manages to deliver its new OS and great new smartphones in early Q1 2013, it may finally see its own fortunes change.

Samsung’s sales have been substantial, not only on the smartphone end but in total mobile devices, as all three research reports have shown. It is noteworthy that Samsung’s current overall market share number – as shown in the chart below – makes it the first company to hold more than 31 percent market share in a single quarter since Q4 2009.

Nokia clings to second place on this chart, by virtue of its many razor-thin margin Symbian devices still in circulation.

.JPG)

The bottom line of course is that we will continue to see smartphones dominate the mobile phone landscape, and we can – with virtual certainty – claim that both Samsung and Apple will retain their respective places. Although Apple is going to earn the most revenue by virtue of owning and retaining the number one position in “most desirable smartphone,” which continues to provide Apple with enormous pricing leverage.

Edited by

Braden Becker