It should come as no surprise to anyone at this point in time that the PC market is indeed now in a state of long-term decline. The decline is inevitable, and it will continue - on both the consumer and enterprise end of it - until we reach an equilibrium point at some point in the future where PC shipments will cover PC replacements for those areas of both consumer and business where PCs remain the "right" tool to use.

It will be many years in the future before PCs disappear for real, but at this point in time, what is really going on is that the arrival of tablets and smartphones is uncovering those areas of our lives where PCs never needed to intrude in the first place if the right tools had been in place.

For those among us who do nothing but surf the Web and hang out on Facebook, who really needs a PC? "Not very many folks" is the correct answer. And in truth, over the entire last decade and into today the PC market had continued to grow on the consumer side because there were no other options available to us.

That all changed, of course, thanks to Apple.

There is still the high-end, hardcore gaming market, and some of us simply crave the power you can still only get in a PC (whether a Mac or Windows machine), though we anticipate even this will change over the next five years or so.

Relative to this argument, where are we then at this current point in time on PC shipments and overall PC market penetration? Research firm Gartner has some insight for us, at least as far as Q4 2012 is concerned.

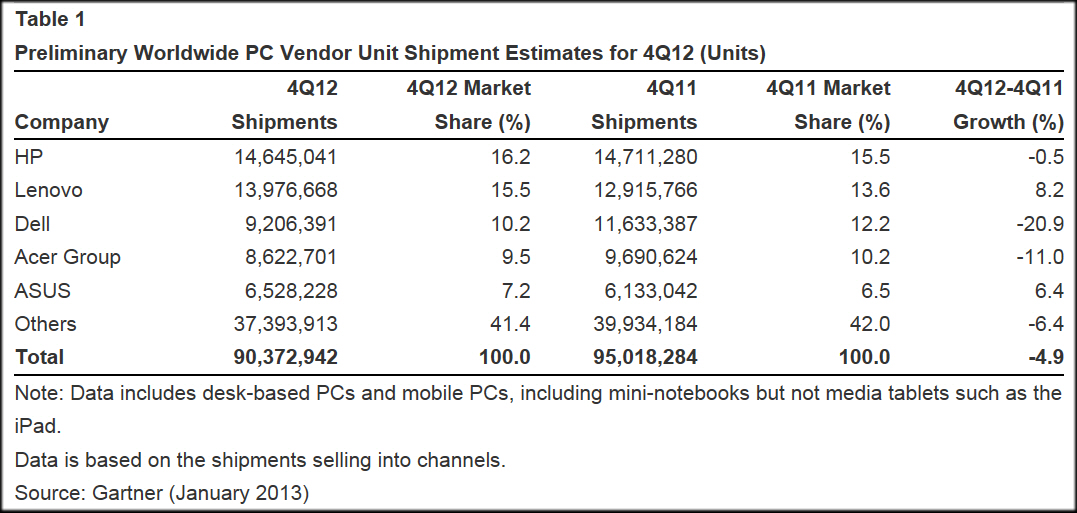

Let's start with the actual numbers. For Q4 2012, worldwide PC shipments totaled 90.3 million units - a non-trivial 4.9-percent decline from Q4 2011, according to preliminary results by Gartner. We will note here that preliminary results within Gartner analysis do not typically stray far from finalized numbers, so we're safe in making use of them. Gartner suggests the PC industry’s problems point to something beyond a weak economy.

Not that this is something the PC industry hasn't already figured out. This is the underlying reason Microsoft pulled its Surface tablets strategy together.

A significant indicator for the PC market's future is that the holiday season has made it clear that consumers no longer view PCs as a "number-one" gift item. As we noted in our first paragraph above, Gartner points out that given the quickly growing variety of increasingly more attractive devices and services, consumers are now directing their attention elsewhere.

Gartner also notes that the launch of Microsoft’s Windows 8 provided an insignificant impact on Q4 2012 PC shipments. Gartner suggests that PC vendors unfortunately offered "somewhat lackluster form factors" in their Windows 8 offerings and missed the excitement of touch. We view that as an understatement, and it's clearly something that Microsoft feared would happen, which is yet another reason it delivered the Surface tablet.

It is certainly true that we can expect Microsoft's hardware partners to begin driving more and better Windows 8 designs, and this may boost some level of PC sales within the installed base. But even so, we do not anticipate that it will change the inevitable.

The chart below, provided by Gartner, shows the numbers behind the 4.9-percent drop.

Mikako Kitagawa, principal analyst at Gartner, noted that, “Tablets have dramatically changed the device landscape for PCs, not so much by cannibalizing PC sales, but by causing PC users to shift consumption to tablets rather than replacing older PCs. Whereas as once we imagined a world in which individual users would have both a PC and a tablet as personal devices, we increasingly suspect that most individuals will shift consumption activity to a personal tablet, and perform creative and administrative tasks on a shared PC. There will be some individuals who retain both, but we believe they will be exception and not the norm.

Therefore, we hypothesize that buyers will not replace secondary PCs in the household, instead allowing them to age out and shifting consumption to a tablet.”

“This transformation was triggered by the availability of compelling low-cost tablets in 2012, and will continue until the installed base of PCs declines to accommodate tablets as the primary consumption device,” Ms. Kitagawa continues. “On the positive side for vendors, the disenfranchised PCs are those with lighter configurations, which mean that we should see an increase in PC average selling prices (ASPs) as users replace machines used for richer applications, rather than for consumption.”

That viewpoint reprises our own position on PCs, which we believe has been obvious since at least 2010. The latest Gartner numbers point to this hard reality.

As the chart above shows, HP regained first place in worldwide PC shipments in Q4 2012. What is also clear is that HP didn't accomplish this by growing market share. Gartner believes, and we concur, that even to hold on to its current level of market share HP likely had to take a non-trivial hit on margins through providing a variety of holiday sales price points.

Lenovo fell to number two, but unlike HP it experienced some growth rate (8.2 percent) worldwide.

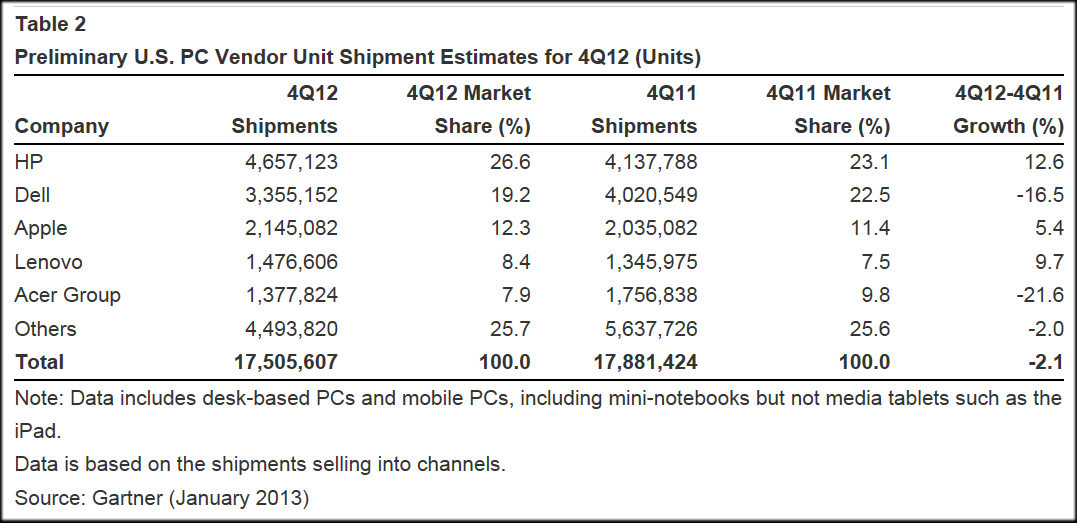

In the U.S., PC shipments totaled 17.5 million units in Q4 2012, representing a 2.1-percent decline from Q4 2011 overall, as the chart below indicates.

Likely due to the same margin issue raised above, HP managed to grow its PC business in the United States, as did Lenovo and Apple - which appears here in the number-three position though is absent from the top five in global numbers. Dell, meanwhile, demonstrates significant weakness on both the global and local U.S. fronts. Acer suffered a significant U.S. loss - is it any wonder it continues to bash Windows 8 and Microsoft's Windows 8 advertising?

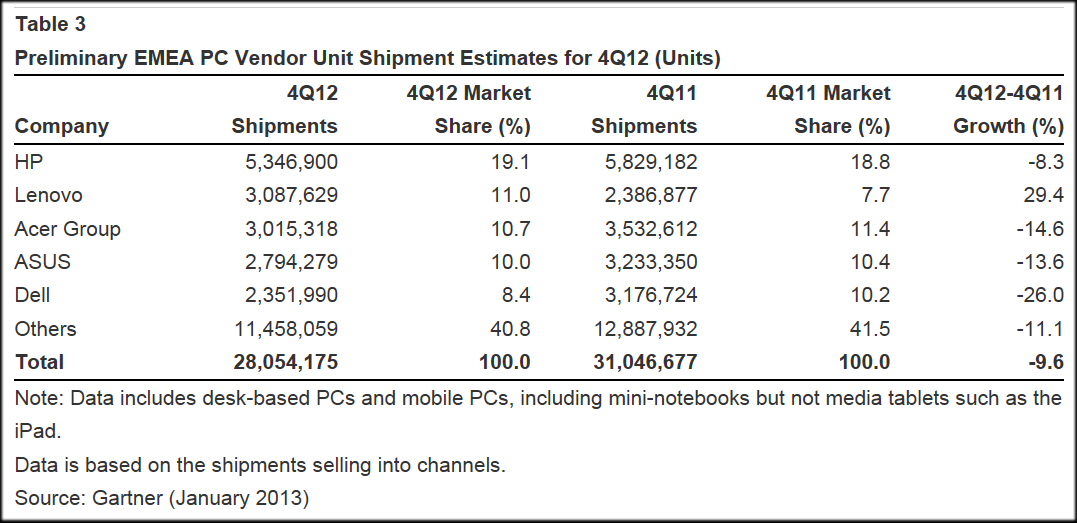

The chart below shows PC shipments for EMEA, which indicates as well that the EMEA market is larger than the U.S. market by roughly 10.5 million units. Total shipments in that global region hit 28.1 million units in Q42012, a huge 9.6-percent decrease from Q4 2011. Gartner further notes that Western Europe is the weakest point across EMEA, as Central and Eastern Europe and the Middle East and Africa saw growth between Q4 2011 and Q4 2012.

HP retained its number-one position in EMEA overall, though it did so while losing sales year over year at an 8.3-percent clip. Compare this to Lenovo, which had outstanding sales in EMEA for Q4 2012. It is unclear to us as to why Lenovo has managed to deliver such a sales number relative to the competition, all of who lost significant market share here.

Our own guess is that it has to do directly with Lenovo's laptop designs, which are both aggressive and cutting edge - something that will save the day even in the face of general PC market decline.

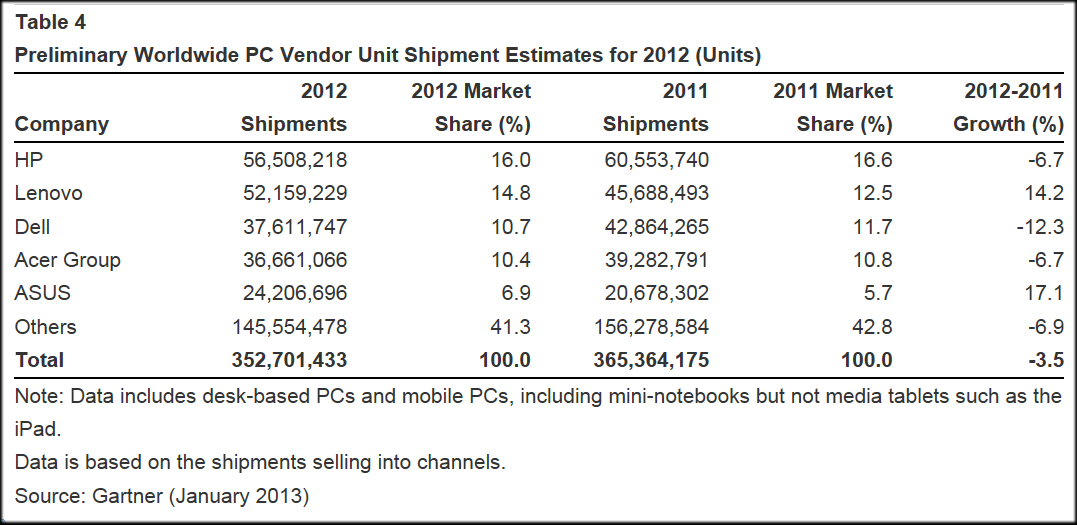

Finally, Gartner also provided numbers for all of 2012 as indicated in the chart below, and again not surprisingly, they show a general decline in PC sales as well. Total PC shipments dropped approximately 13.5 million units to 352.7 million units – a decline of 3.5-percent over all of 2011.

Although HP retained its top spot on a global and yearly basis, it did so through an overall drop in total drop in market share, down to 16 percent overall from 2011's 16.6 percent. Lenovo retained its overall number-two spot with 14.8 percent market share, but unlike HP, it grew its share of the market year over year by an impressive 14.2 percent. Asus delivered the strongest overall growth among the top five vendors, with total units shopped increasing 17.1 percent.

Though it remains in fifth place overall by a fairly wide margin, it never the less shaved that number by about four million total units – an impressive number given the overall market.

As Gartner points out, the results in the charts presented here are preliminary though we do not anticipate final numbers varying much from those presented here. We do note as well that Windows 8 hasn't been around long to have affected Q4 2012 numbers, and we need to take a close look at what Q1 2013 numbers show us as far as what its longer term effect on PC shipments is likely to be.

Edited by

Braden Becker