Back in October 2012, we took a fairly detailed look at the likely market size for the wearable tech market between now and roughly the 2016 - 2017 timeframe. At that time, we concluded that there will be an explosion in wearable tech over the next five years. Today we entertain a new study, Smart Wearable Devices: Fitness, Healthcare, Entertainment & Enterprise 2012-2017. The study is by Juniper Research, and its findings strongly correlate to the findings we uncovered in our earlier coverage.

Whereas the earlier study focused on market size from a dollar perspective, Juniper's research targets its forecast based on total number of devices that are likely to be sold. And that number is huge - coming in at 70 million devices in 2017. Last week, we placed an order for our own first piece of true wearable technology - the Pebble Watch, for which we will shell out $150 (we ordered ours in candy red - it looks pretty darn sweet). We're "Swiss Made" mechanical watch lovers, but the integration between the Pebble and iPhone and Android watches is simply too good to not give it a solid shot.

We're obviously early adopters and the price isn't an issue. Before long that $150 will certainly drop, but just to provide some perspective, 70 million devices at $150 each is a $10.5 billion market! Juniper suggests that the wearable smart devices market, including smart glasses, will be worth at least $1.5 billion by 2014, up from $800 million this year.

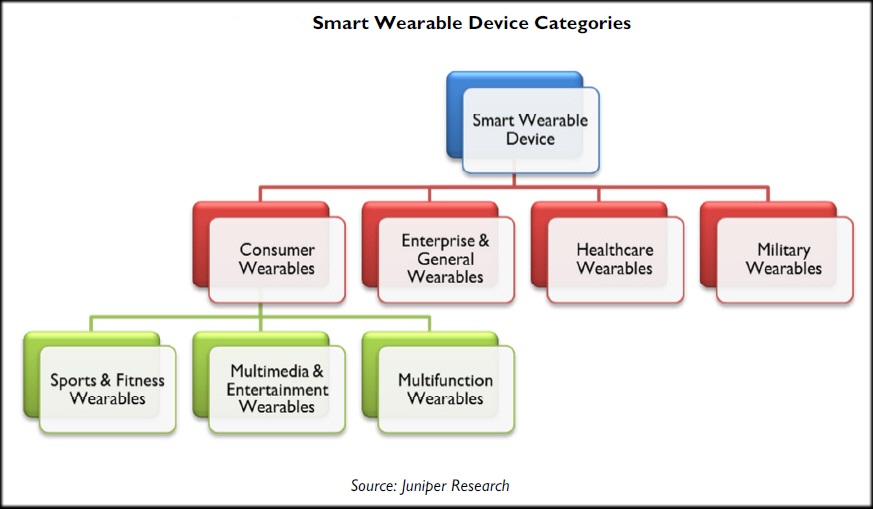

The report from Juniper includes in its definition of smart wearable devices smart glasses, health and fitness devices, along with enterprise and military wearables. In 2013, the report claims that we'll see sales of 15 million devices, with a significant and steady ramp up to 2017 and beyond. Juniper suggests that we'll see the greatest adoption toward the end of the forecast period, driven by the launch of augmented reality glasses and similar products from Google, Microsoft and Apple. Below is a Juniper view of the market overall from a pure devices perspective.

Enterprise wearables will mostly find their first real markets in field service. Motorola Solutions already has an excellent example of such wearable tools in its pipeline.

Fitness Health Will Dominate

The Juniper report clearly underscores that fitness and sports wearables, followed by healthcare devices, will dominate the market with a combined market share of over 80 percent in the final forecast year 2017. It is worth noting, as the research points out, that although the number of fitness and sports devices bought per year will be higher than the number of healthcare devices sold, the health sector overall will own a slightly larger piece of the pie in terms of retail value due to higher price points.

The report further notes that as the retail price for smart glasses decline toward the end of the forecast period, the adoption level amongst consumers will increase by 2017. Of course, this forecast simply points to the usual laws of supply and demand and economies of scale. Still, initially the cost for smart glasses will likely be quite high with prices staying that way until the later end of the forecast period.

It isn't clear yet how quickly the adoption rate for smart eyewear will ramp up - at least in terms of the capabilities scale Google Glass is working with. These aren't going to simply be sunglasses with some Bluetooth connectivity tossed in. That is a different market outside of "smart" wearables.

Mobile App Ecosystem Development Will Prove Critical

It is important to note that the key word in "smart wearable technology" is "smart." And what that means is that mobile applications are going to play the central role here. Given that, it is not surprising that the Juniper report finds that the development of a mobile app ecosystem for wearable devices is essential for creating a platform for further broadening the role of wearable devices.

The report's author, Nitin Bhas, says that, “The development of the smartphone app store model has opened up new avenues for other segments within the market, such as the wearable device market, by combining mobility with an efficient method of software delivery. The simultaneous development of mobile app ecosystems and wearable devices will integrate technologies, such as augmented reality, into human life more seamlessly.” We fully concur.

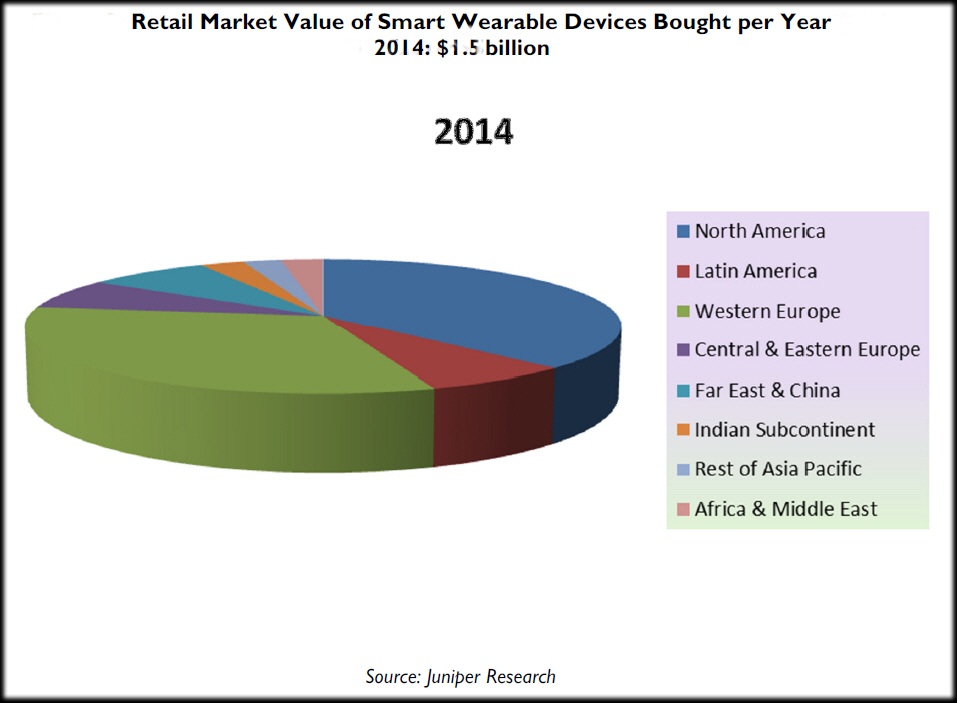

How will that $1.5 billion by 2014 be distributed from a global regional perspective? The chart below provides a good summary. Though percentages aren't included in the chart, Juniper notes in the report that North America and Western Europe combined represent over 60 percent of the total market. That is hardly surprising - in fact we would have estimated it to be higher than that, though Japan and South Korea will also be prime smart wearables markets.

The full Juniper report is available for purchase, and a free whitepaper based on the report is available as well.

Edited by

Brooke Neuman