One has to always ask the question - has the recent huge run up on Google's stock been about solid present and future financial foundations, glorified and hyped future products that may or may not have any future, or simply more of the old fashioned irrational exuberance that characterized the early era of the Web age? Yes.

We might also ask the question, does a $20 drop in stock price following a $400 run up in the price qualify as a "dramatic tanking" of the stock? Surely we don't need to answer that. In any case, the only news worthy of any discussion really, coming out of yesterday evening's Google Q2 2013 earnings call, is at best a simplistic issue regarding whether or not mobility is "hurting" Google's traditional ad-based businesses and whether or not it means anything to have missed analyst consensus expectations.

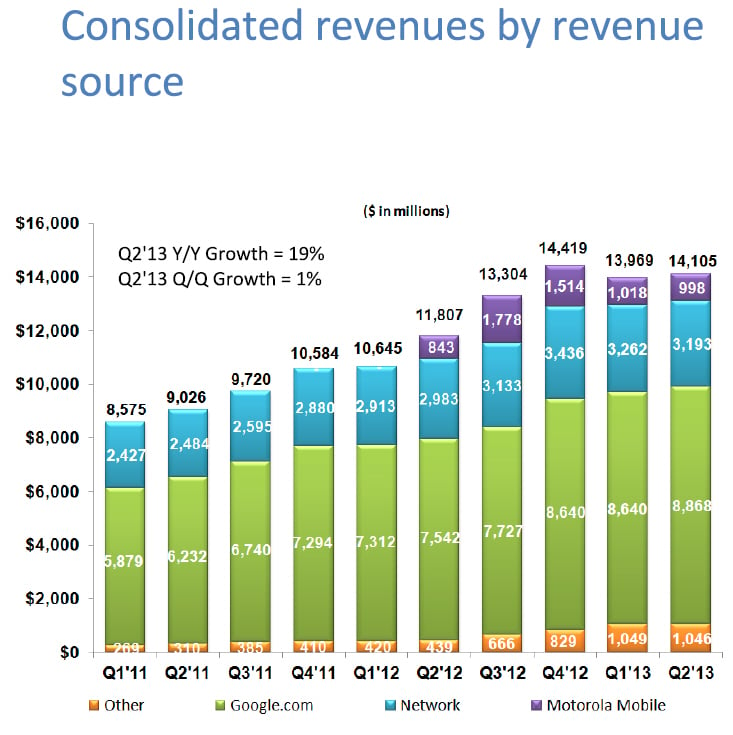

Shown below are the basic revenue numbers, including comparisons to previous quarters.

The reality is that these numbers do not in any way point to a rational reason for the stock's run up. Nor do they point to Google delivering anything other than slow and steady growth – which is all one can ask for from a huge and maturing company. It is true that, unlike Microsoft, Google is at least able to generate genuine waves of innovative thinking – complete with tangible, if not particularly real, products that may or may not have sustainable and non-trivial future revenue generation capabilities. For example, will Glass really drive new revenue? Will it non-trivially drive ad-based and/or mobile revenue for Google? Google is now so massive that the term "non-trivial" takes on daunting proportions.

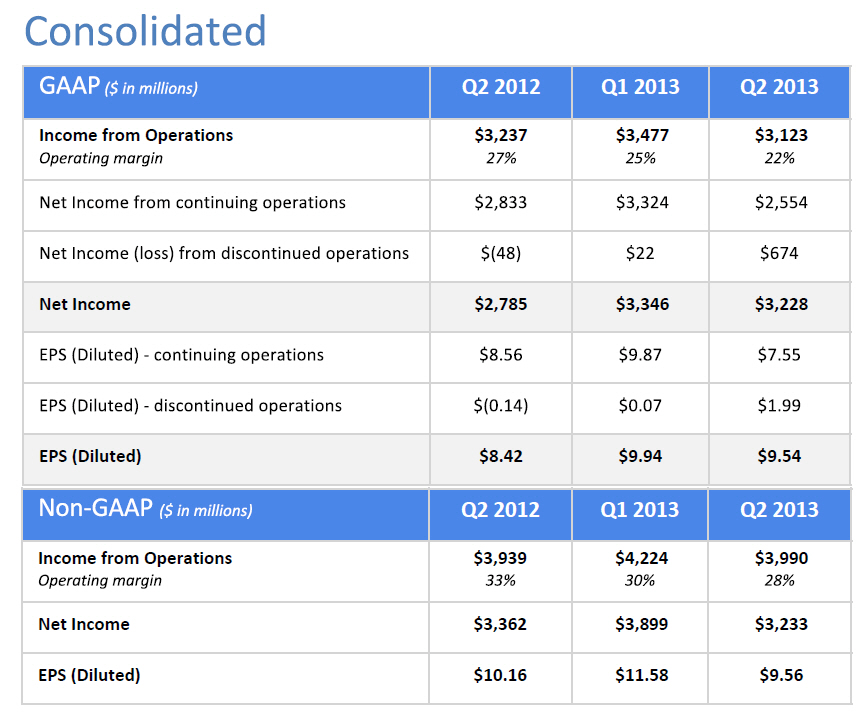

Shown below are the consolidated net profit numbers.

What's not to like here? Well. Earnings per share are down, and in fact, relative to Q1 2013, they are down substantially. That in and of itself doesn't mean anything. There are no new Google products on the street for the quarter and given the numbers for the Q4 2012, holiday buying season and some overlap of that with Q1 2013, we doubt Google could have done anything to make the EPS any better for the quarter. That said, consensus analyst EPS estimates for Q2 2013 were $10.81 per share.

That number tells the current story and frames the questions we began with. Google shares are down at the moment to $880.24 – a drop of $30.44 from yesterday's close. Does it mean anything? Of course not. It leaves us as always asking of the financial analysts – what were they thinking in the first place? That is where the irrational exuberance part of the equation comes in. We could also refer to it as a flight of fancy. Take your pick.

There is nothing else to parse from Google's Q2 2013 numbers. Of course, the pundit headlines are now beginning to scream out questions about mobility killing off the Google golden goose— and of course this is nothing more than minor hysterical noise. Even as the world begins to think of "mobility" as being a now mature and mainstream technology issue - both on the enterprise and consumer side, the fact is that we are still in nothing more than the early days of mobility.

Google will find the right balance between its traditional search ad business avenues and its growing mobility avenues of growth. But please, don't be a fool and use Google's Q2 2013 numbers to lay any claims to mobility affecting Google's long term business. Those who drove the stock from $400 to $900 can't be that simplistic in their thinking…can they? We look forward to what will be said when the numbers for the holiday quarters arrive.

Irrational exuberance – déjà vu!

Edited by

Ryan Sartor