Ever wonder how fast the U.S. subscriber base for broadband is or isn’t growing? What about who is winning the pitched battle between cable and telecom companies to capture those highly desirable customers who can’t live without fast Internet access? The answer to both of those questions comes in the form of a new Leichtman Research Group, Inc. (LRG) study on U.S. broadband. There is good news on the subscriber front and illuminating news on the cable versus telephone company front. If nothing else, it is an interesting snapshot in time to contemplate.

Let’s take a look.

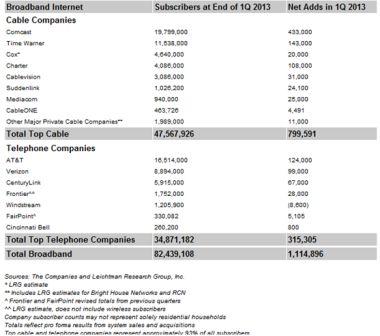

U.S. Broaband Subscriber Q1 2013

[Please click on the image to enlarge]

Source: Leichtman Research Group, Inc.

Of the 17 largest cable and telephone providers in the U.S.—representing about 93 percent of the market – the researchers found that, combined, they acquired 1.1 million net additional high-speed Internet subscribers in the first quarter of 2013.

The group now has over 82.4 million subscribers. Interestingly, top cable guys have over 47.5 million broadband subscribers, while the top telephone companies have 34.9 million subscribers.

A closer look at the broadband subscription numbers

Additional granularity in the numbers for the first quarter of 2013 includes:

- Total broadband additions in 1Q 2013 were 86 percent of those in 1Q 2012— cable had 82 percent more additions as a year ago, and telcos 99 percent.

- Cable added roughly 800,000 subscribers, representing 72 percent of the net broadband additions for the quarter versus the top telephone companies.

- AT&T and Verizon added 919,000 fiber subscribers (via U-verse and FiOS) but had a net loss of 696,000, which indicates the challenges telephone companies are having competing for new customers, although they appear to have a loyal base to migrate DSL subscribers.

- U-verse and FiOS account for 40 percent of the top telcos' broadband subscribers compared to 32 percent a year ago, validating the observation in the previous point.

- The top cable broadband providers have a 58 percent share of the overall market, with about 12.7 million more subscribers than the top telephone companies. This compares with 10.8 million last year.

"The first quarter of the year has proven to be the best quarter for net broadband adds in each of the past seven years, and from 2010-2012 net adds in the first quarter were greater than in the second and third quarters combined," said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. "2013 began with another strong first quarter. Net broadband additions in 1Q 2013 were about 500,000 more than in 4Q 2012."

It is difficult to look at these numbers without thinking about the success the cable companies have enjoyed at the expense of the telephone companies. If you had asked industry observers a few years ago to place bets on who would have the largest market penetration of broadband customers today, odds are, based on robust projections of how much the telephone operating companies said they wanted to invest in bringing broadband to as many residences as possible, that they would not be in second place.

The facts are that marketplace investment obligations and opportunities along with changing consumer purchasing habits got in the way. Mobility took off, which meant heavy investing by telephone companies in mobile infrastructure (now more than a bit threatened by cables’ strategic use of Wi-Fi hotspots and alliances), and it turned out that cable companies knew how to market triple-play packages and were able to better leverage their engagement with customers and their desire for TV programming to add Internet and phone more easily than telephone companies were to leverage their phone service as the anchor for triple play. Plus, as the numbers show DSL is not competitive for those with a need for speed, and telephone companies still have a long way to go on broadband coverage, although at least they seem to be able to convert DSL customers when they decided to upgrade.

Can VDSL2 Vectoring help the telephone companies turn the tide? It certainly is helping in Europe. Is the U.S. still behind places like South Korea and Japan in terms of broadband penetration? Yes it is. The trend of increasing net subscription is certainly heartening, but there is still a long way to go to catch up on this front as well. Given the aggressive marketing by cable and telephone companies, it will be fascinating to see not only if the market as a whole is growing, but also who has traction.

Edited by

Alisen Downey