For those of us who track the telecom industry closely, we have an insatiable appetite to find out how the various vendors are doing both generally and in their competition with each other. Market research firm Infonetics Research is releasing excerpts from its 2013 Telecommunications Equipment Vendor Leadership Scorecard, which will be available next week. The headline here is this is a close race to the top.

The report profiles, analyzes and ranks the six leading telecom infrastructure, software and services vendors: Alcatel-Lucent, Cisco, Ericsson, Huawei, NSN and ZTE. The value in the scorecard is, as Infonetics says, “The scorecard evaluates vendors on criteria using actual data and metrics. “ It is based on: direct feedback from buyers, vendor market share, share momentum, financials and solution portfolio.

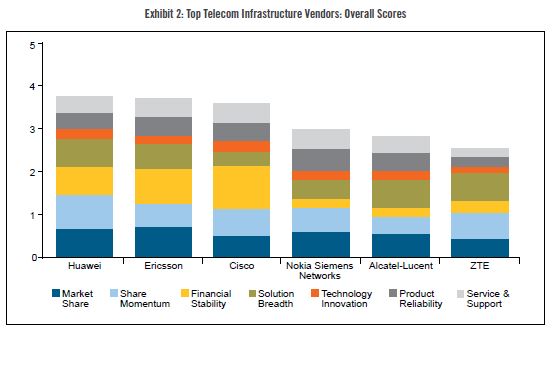

This annual report uses a set of criteria commonly used by buyers to select vendors, demonstrate success in the marketplace, and position a vendor for future success. The matrix rankings are based on seven criteria, including:

- Market share

- Market share momentum

- Financial stability

- Solution breadth

- Technology innovation

- Product reliability

- Service and support

"The six vendors profiled in our telecom scorecard together earn more than half of the world's telecom equipment and service revenue and share a common thread: they offer products and services across the entire telecom spectrum," notes Michael Howard, co-founder and principal analyst for carrier networks at Infonetics Research.

image via shutterstock

"The race for top ranking was tight this year," continues Howard. "The top three vendors-Huawei, Ericsson and Cisco-are bunched closely together due to different strengths, but it's financial stability that sets them apart from the other 3 vendors-Alcatel-Lucent, NSN and ZTE."

It really is close

The highlights of the report are as follows:

- With a solid performance in market share, market share momentum and solution breadth, Huawei received the highest overall score for telecom vendor equipment and services.

- Ericsson, the world's largest provider of telecom equipment and services, took the number two spot, finishing a whisker behind Huawei; Ericsson nabbed above-average scores overall and, thanks to its RAN offering, is in a good position to grow as the world continues to go mobile

- Cisco, number one in Infonetics' companion enterprise scorecard, comes in third in the telecom infrastructure scorecard, earning high marks for financial stability and technology innovation.

- The other vendors analyzed in the report-Alcatel-Lucent, NSN and ZTE (in alphabetical order)-are well behind the top three, but each has corrective measures in place for 2013:

- Through its SHIFT plan, AlcaLu is prioritizing its product portfolio and investing in fewer segments going forward

- Nokia has announced the buyback of Nokia Siemens Networks from Siemens

- ZTE is re-strategizing and has a strong Chinese service provider base to fund global expansion plans

The report is extremely comprehensive containing not just the scorecard but as the highlights above indicate it also includes in-depth analyses of the relative strengths and weaknesses of the profiled companies.

For a limited time, service providers and enterprises can download Infonetics' telecom vendor scorecard free of charge (a $500 value) at http://www.infonetics.com/download.asp?id=37. And, the sneak peak below should provide ample reason to get a copy.

Source: Infonetics Research 2013 Telecommunications Equipment Vendor Leadership Scorecard

There is an old saying that, “You can’t tell the players without a scorecard.” Infonetics not only has provided us with a good one, but also a nice tout sheet for those of us who like to handicap these types of races. With the corporate earnings season now in full swing, and the industry continuing to remain volatile—Huawei possibly being forced to ignore the US market and have questions raised in India regarding security, Alcatel-Lucent restricting and Nokia taking full control of NSN, just as examples—this is a valuable tool for evaluating not just past but future performance.

Edited by

Ryan Sartor