On August 2, 2012 LinkedIn, which now has over 175 million members, reported financial results for its fiscal Q2, which ended June 30, 2012. The results demonstrate a company operating with all eight cylinders firing.

It’s clear that LinkedIn has developed a number of viable paths to monetization of its social-business networking capabilities. Quite a difference from the image Facebook projected last week during its earnings call, which spurred some serious and extremely silly analyst angst about social media.

Here are the highlights straight from LinkedIn, which will certainly restore some social media sanity:

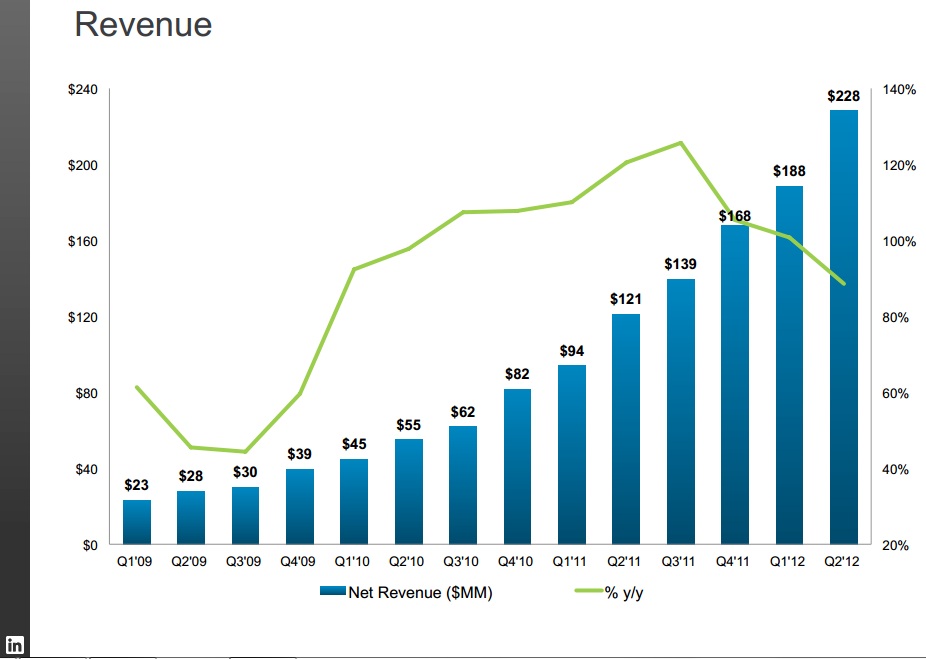

- Revenue for the second quarter was $228.2 million – an increase of 89 percent compared to $121.0 million in the second quarter of 2011.

- Revenue from the U.S. totaled $147.3 million, and represented 65 percent of total revenue in the second quarter of 2012. Revenue from international markets totaled $81.0 million, and represented 35 percent of total revenue in the second quarter of 2012.

- Net income for the second quarter was $2.8 million, compared to net income of $4.5 million for the second quarter of 2011. Non-GAAP net income for the second quarter was $18.1 million, compared to $10.8 million for the second quarter of 2011.

- Non-GAAP measures exclude tax-affected stock-based compensation expense and tax-affected amortization of acquired intangible assets.

- Adjusted EBITDA for the second quarter was $50.4 million, or 22 percent of revenue, compared to $26.3 million for the second quarter of 2011, or 22 percent of revenue.

- GAAP EPS for the second quarter was $0.03; Non-GAAP EPS for the second quarter was $0.16.

Below is the full historical revenue growth chart for LinkedIn – clearly the company has been doing its homework.

A full set of LinkedIn financial charts is available as well. See the graph to the right in its full size on page 5 of the LinkedIn publication.

“LinkedIn had a strong second quarter, with all of our key operating and financial metrics showing solid performance,” said Jeff Weiner, LinkedIn’s CEO. “Our ongoing investment in product innovation drove healthy engagement as measured by unique visiting members and member page views, and our three revenue streams – Hiring Solutions, Marketing Solutions and Premium Subscriptions – all experienced significant growth.”

Highlights for LinkedIn’s core monetization strategies (again, straight from LinkedIn itself) are as follows:

- Hiring Solutions: Revenue from Hiring Solutions products totaled $121.6 million – an increase of 107 percent compared to the second quarter of 2011. Hiring Solutions revenue represented 53 percent of total revenue in the second quarter of 2012, compared to 48 percent in the second quarter of 2011.

- Marketing Solutions: Revenue from Marketing Solutions products totaled $63.1 million – an increase of 64 percent compared to the second quarter of 2011. Marketing Solutions revenue represented 28 percent of total revenue in the second quarter of 2012, compared to 32 percent in the second quarter of 2011.

- Premium Subscriptions: Revenue from Premium Subscriptions products totaled $43.5 million – an increase of 82 percent compared to the second quarter of 2011. Premium Subscriptions represented 19 percent of total revenue in the second quarter of 2012, compared to 20 percent of revenue in the second quarter of 2011.

LinkedIn accomplished a number of things during its second quarter – some of them are strategic in nature and worth noting.

The company launched its first app directly designed for the iPad. More than half of current page views are being generated by content-focused products such as updates, news and groups – an encouraging sign of useful mobile engagement. LinkedIn has also simplified the design of its social news product LinkedIn Today and has added deeper integration into the homepage.

The result here has been very positive, with LinkedIn Today engagement now up over 150 percent since the new features were implemented.

Additionally, in July the company began to roll out a major homepage redesign, which has begun to positively impact engagement metrics. Shares originating on LinkedIn, for example, have now reached all-time highs.

Finally, the company has now completed the rollout of its Talent Pipeline to all of its LinkedIn Recruiter customers. These Recruiter customers have managed to add over one million prospective candidates into Talent Pipeline since the rollout began. That is an impressive number.

Business Outlook – Looking Well Run

Now for that all important piece of the earnings call that Facebook failed to deliver on – guidance for the next fiscal quarter and the full fiscal year.

The company anticipates that Q3 2012 revenue for will be between $235 million and $240 million, with adjusted EBITDA to fall between $42 million and $45 million. For the full year LinkedIn now expects revenue to be upwards of $915 million, possibly to $925 million. LinkedIn previously stated that full-year revenue would be between $880 million and $900 million. Adjusted EBITDA has also been revised upward, and is expected to fall between $185 million to $190 million, a significant boost from the prior numbers of $170 million to $175 million.

One thing we would like to hear more about is more detail land insight on LinkedIn’s mobile plans, especially on the mobile ad front, which the company hasn’t detailed as aggressively as it has other components of its forward looking business plans. Weiner did note that LinkedIn launched its first test on delivering mobile ads on this quarter with a number of large companies, the list of which includes Shell.

He also noted that more than 15 percent of new member registrations came via mobile phones in Q2 – up a bit from 10 percent in fiscal Q1.

It is fair to say that LinkedIn’s IPO, while initially striking some of us as overly rich at the time of the IPO itself, has proven to be the one success amongst a number of more bubble-like launches.

Facebook notwithstanding, has anyone taken a look at Zynga lately? As we speak, LinkedIn shares are at $104.05, up $10.54, or 11.27 percent. Not bad! Those financial analysts that pushed out the social media market hysterics last week can now chill out.

Tony Rizzo has spent over 25 years in high tech publishing and joins TechZone360 after a stint as Editor in Chief of Mobile Enterprise Magazine, which followed a two year stretch on the mobile vendor side of the world. Tony also spent five years as the Director of Mobile Research for 451 Research. Before his jump into mobility Tony spent a year as a publishing consultant for CMP Media, and served as the Editor in Chief of Internet World, NetGuide and Network Computing. He was the founding Technical Editor of Microsoft Systems Journal.

Edited by

Braden Becker