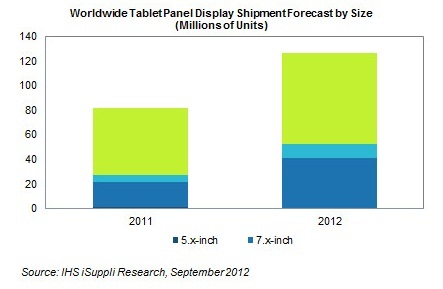

Flourishing tablet shipments, projected to reach 126.6 million units, up from 82.1 million units in 2011, a huge 56 percent annual increase in shipments for the tablet display market in 2012. This number is the latest to provide a clear indication that the overall tablet market remains not only robust but on a significantly large growth trajectory. Here are some key statistics from IHS iSuppli’s latest research on tablet display shipments:

- Approximately 74.3 million units, or 59 percent of all tablet display panel shipments will come from the 9.x-inch segment, of which the iPad is, of course the absolute king of the hill. Growth in the 9.x-inch tablet panel sector this year is forecast to rise 35 percent from 55.2 million units in 2011.

- Meanwhile, regardless of the old Steve Jobs line that seven inch tablets are dead on arrival, the second-largest size segment for tablet displays this year will be the 7.x-inch, a market which Apple itself is very likely to join within the next month. Shipments of the 7.x-inch tablet display in 2012 will amount to 41.1 million units, nearly double from 20.8 million units last year. This is important to note because it translates into 7.x-inch category growth that will control 32 percent of the tablet display space in 2012, compared to 26 percent in 2011.

- The 7.x inch market segment is beginning to take market share from the still dominant 9.x-inch sector. The 7.x-inch category will clearly be aided by the launch of lower-priced 7.x inch tablets – both Amazon and Google are delivering real market impact.

- The rest of the tablet display market in 2012 will be divided between the 8.x-inch size, with approximately 9 percent share; and the 5.x-inch, with less than 1 percent share.

Apple appears to have little choice but to follow suit in the 7.x inch market (following suit is certainly a rarity for Apple, and it will be interesting to see if Apple immediately ends up dominating the 7.x inch space or if it will find itself playing in a much more challenging environment that it may ultimately not dominate and may even find itself having to settle into a third place position) – it is an interesting side bet to make – our own sense of it is that it bests Google but will permanently stay behind Amazon here.

Generally, shipments for tablet displays actually declined by 20 percent sequentially in the first quarter of 2012. This was due entirely to seasonal trends, with tablet device makers, according to iSuppli, looking to flush out a significant amount of inventory that had built up in the fourth quarter of 2011. The vendors were successful in their efforts, as indicated by the subsequent huge increase in tablet display shipments in Q2 2012. One definite expectation here considering this growth is that we can look for many new tablet launches the rest of this year.

LG and Samsung Dominate

LG Display and Samsung Display remain the main suppliers of tablet displays. In Q1 2012 LGD shipped 42 percent of all tablet displays, with Samsung Display owning 38 percent market share. Both companies make the LCD panels that are used in the iPad, which dominates the tablet space with a whopping 58 percent of all tablets shipped in Q1 2012. LG Display is also a key supplier to Amazon and Barnes & Noble. Samsung of course also provides panels to its own tablet division.

The iSuppli report also notes that investments are being made by both companies in capacity allocation and technological improvements to supply high-performance tablet panels and to develop wide-viewing-angle technologies like in-plane switching and fringe-field switching. Both LG and Samsung are also looking to convert amorphous-silicon fabs into making oxide silicon panels to help improve tablet panel resolution, power consumption and overall performance.

As reflected by Apple’s choice of suppliers for the iPhone 5 screen, Japanese suppliers are finally waking up. In particular Sharp, Japan Display and Panasonic are now moving quickly to become meaningful tablet display suppliers. Together the capacity allocation this year for small and medium displays by the Japanese is expected to increase 164 percent from last year’s levels. Of particular interest is the oxide silicon capacity at Sharp, which has been supplying panels for the new iPad. Panasonic is likely to produce 7.x-inch and 8.x-inch tablet panels during the second half of this year.

Finally, iSuppli reports that the LCD suppliers based in Taiwan, which include AU Optronics (AUO) and ChiMei Innolux, are reportedly adjusting their business models - some to focus on tablets for the education sector, and others to supply tablets for the white-box market in China. In fact, it is currently believes to be the case that AUO may be one of the suppliers qualified to supply the upcoming smaller iPad’s 7.85-in panels.

But unlike Tier 1 tablet display makers LGD and Samsung Display, Taiwanese panel suppliers primarily target the Chinese market that is geared more toward lower-priced tablets. To meet lower price points, display specifications are usually dialed down compared to Tier 1 products. Look for the likes of Huawei, which is stepping up its own mobile device efforts in China and globally, to possibly become a key buyer for the Taiwanese vendors.

In any case, the bottom line, as the iSuppli data clearly shows, is that the tablet market is set to take off in a huge way. Apple will continue to lead the way, but as Windows 8 becomes real, we can also expect an entirely different avenue of growth for tablets.

Edited by

Brooke Neuman