Well. We're not sure if we should be surprised or not by this, but Twitter has filed an amended S1 form with the SEC that notes the company will look to launch its IPO on the New York Stock Exchange (NYSE Euronext) and will use the ticker symbol TWTR in doing so (which we certainly think is better than TWIT). The TWTR end of it is not surprising, but planning to launch on the "venerable" (or what used to be the venerable) NYSE seems almost wrong to us.

Nasdaq has long been the fertile and de facto IPO launching ground for tech companies over the years, and seeing TWTR heading to the NYSE simply doesn't feel right. Or perhaps it's all better qualified as, "My, how the times have changed…yet again." The NYSE still conjures up images of staid companies that we think of as "old time stocks." They aren't for the most part any such thing of course, but the image remains. The NYSE for its part issued a tweet saying it was "grateful" for the confidence shown in it by Twitter. The old, venerable NYSE would have expected whatever company it deemed worthy to play with it to send the thanks in its direction.

More likely, the Nasdaq disaster also known as the Facebook IPO may have had something to do with Twitter's decision to go with the NYSE. The problems Nasdaq had were hardly acceptable and investors were harmed. Nasdaq itself had to cover a substantial fine as well. None of this is particularly inspiring, though we think of it more as an anomaly than anything else.

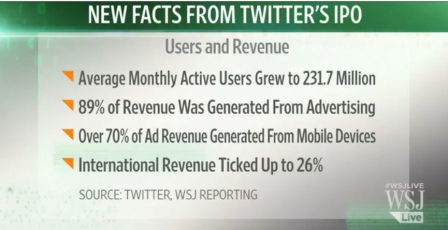

Twitter will be launching its IPO "road show" on Oct. 25, 2013, and is subsequently expected to formally price its shares on Nov. 14 and with actual trading beginning on Nov. 15. How the stock will be priced will be interesting to see. The amended IPO itself had some interesting details in it that may or may not affect it. Here are several pieces of information the Wall Street Journal compiled - for which we thank WSJ.

As the numbers show, at 89 percent advertising is essentially the only real source of revenue for Twitter. There is no surprise here necessarily - but investors need to understand that this is the revenue source. Also unsurprising is that 70 percent of advertising revenue is generated through mobile devices. This can only grow though keep in mind that mobile devices encompass tablets as well as smartphones.

If tablets eventually replace desktops/laptops will that "mobile" distinction cease to matter? Probably yes, but the "mobile factor" will still matter as tablets will always create much greater anywhere, anytime opportunities going forward than exist today. So at the least Twitter is engaging people in the way that matters most both today and tomorrow.

While subscriber growth continues to grow, and average monthly "active" users also grew - to 231.7 million, there is an uneasy sense that the growth rate - especially in the United States, is reaching a point of saturation. The overall rate of growth, while still positive, has slowed - and heading into an IPO investors need to consider this relative to advertising-based future revenue.

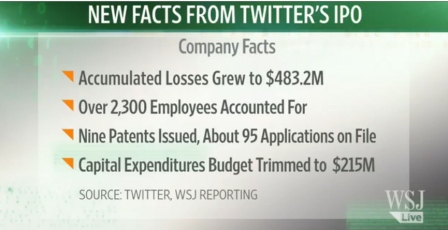

The second chart more or less confirms what we already know. Employees are now totaling about 2,300 - which seem quite high - we'd certainly like a better accounting of how all of these employees are actually deployed across what specific groups. That capital expenditures are down doesn't mean a lot at this point.

Accumulated losses total $483.2 million, but this number doesn't mean a lot either. The question is whether or not ad revenue will be enough to quickly move beyond losses or if there is still a great deal of investment that needs to be made from revenue dollars, which will keep losses up and profit down. Is Twitter truly a maturing entity with a now proven revenue model that can take advantage of revenue to build profit or is it still in reality more nascent than most of us believe and a company with significantly untapped revenue potential?

If we compare it to the Jeff Bezos Amazon model, we want to believe the latter. As investors this seems to us where we would hope a future Twitter needs to go. Are there a lot of possibilities here - such as, for example, Twitter's @EventParrot experiment, that aims to deliver personalized breaking news? Breaking news is a huge Twitter asset - are there ways to continue tapping into this asset?

If we consider the former - a maturing entity, there is probably not a lot of new opportunity for Twitter to grow much beyond the core numbers we see here - even if it is able to turn a profit. Does it eventually become a cheap public acquisition for a Facebook or Google or Microsoft?

These are all interesting new numbers but as far as the IPO itself is concerned it doesn't change anything. Our earlier analysis on how to play the Twitter IPO game still holds.

Buyer, beware - keep the panic level extremely low, patience level high, and make sure you know when not to sell.

Edited by

Alisen Downey