As we look ahead to Microsoft's formal earnings call and details later today at 5:30 p.m. EST, we are able to report that Microsoft once again delivered record revenue of $24.52 billion for its fiscal Q2 2014, which ended on Dec. 31, 2013. Look for our detailed Microsoft earnings analysis tomorrow morning. Here are the relevant numbers:

- Gross margin was $16.24 billion

- Operating income hit $7.97 billion

- Net income for the quarter was $6.56 billion

- Earnings per share (EPS) came in at $0.78

And now here are the numbers that really matter:

- EPS for the quarter of $0.78 beat consensus analyst estimates by a significant $0.10

- Total revenue beat consensus analyst estimates by $850 million

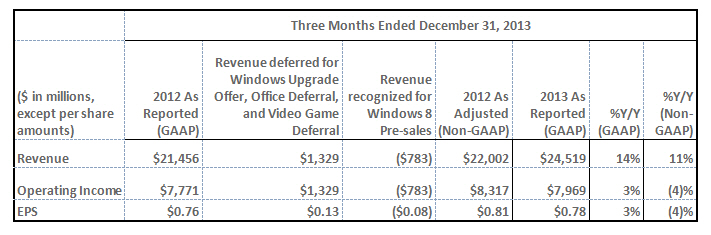

The chart below provides Microsoft's usual overview of GAAP and non-GAAP financial results.

(Click to enlarge)

Devices and consumer revenue grew 13 percent overall to $11.91 billion. The breakdown is as follows:

- Windows OEM revenue declined 3 percent (as was anticipated), reflecting strong 12 percent growth in Windows OEM Pro revenue, but offset by continued softness in the consumer PC market

- Surface tablet revenue more than doubled sequentially, from $400 million in fiscal year 2014 to $893 million in fiscal Q2 2014

- 7.4 million Xbox console units were sold into the retail channel, including 3.9 million new Xbox One consoles and 3.5 million Xbox 360 consoles

- Bing search share grew to 18.2 percent and search advertising revenue grew 34 percent

Commercial revenue grew 10 percent to $12.67 billion. The general breakdown is as follows:

- SQL Server continued to gain market share with revenue enjoying double digit growth

- System Center demonstrated continued strength with its own double digit revenue growth

- Commercial cloud services revenue more than doubled

- Office 365 commercial seats and Azure customers both grew triple digits

Image via Shutterstock

Outgoing CEO Steve Ballmer noted, "Our Commercial segment continues to outpace the overall market, and our Devices and Consumer segment had a great holiday quarter. The investments we are making in devices and services that deliver high-value experiences to our customers, and the work we are doing with our partners, are driving strong results and positioning us well for long-term growth."

Kevin Turner, Microsoft's COO pointed out, "Our commercial cloud services revenue grew more than 100 percent year-over-year, as customers are embracing Office 365, Azure, and Dynamics CRM Online, and making long-term commitments to the Microsoft platform."

All in all, that is yet another solid quarter for Microsoft. The company will provide substantially more detail during its earning call later this evening - we'll report back in our detailed analysis in the morning.

Edited by

Alisen Downey