Apple has just released its fiscal Q1 2014 earnings - the period that covers the 2013 Q4 holiday buying season - typically the biggest quarter of the year for Apple - and the results weren't quite spectacular, to say the least. The company will be holding its earnings call at 5 pm EST today, and we'll have more on that in a later detailed article. For now, suffice it to say that Apple exceeded expectations, disappointed on guidance and now sets the stage for what should prove to be a very interesting 2014.

Here are the numbers that matter:

- Apple posted record quarterly revenue of $57.6 billion

- Quarterly net profit came in at $13.1 billion, or $14.50 per share

- Gross margin was 37.9 percent compared to 38.6 percent in the year-ago quarter

- International sales accounted for 63 percent of the quarter’s revenue

These results compare to revenue of $54.5 billion and net profit of $13.1 billion, or $13.81 per share, for Apple's fiscal Q1 2013 quarter last year.

The Company sold 51 million iPhones, an all-time quarterly record, compared to 47.8 million in the year-ago quarter, but alas, that was nowhere near what many analysts including ourselves had been looking for. In fact, the number comes in near the bottom of the range of expectations of 50 million.

Apple also sold 26 million iPads during the quarter, also an all-time quarterly record, compared to 22.9 million in the year-ago quarter.

The Company sold 4.8 million Macs, compared to 4.1 million in the year-ago quarter.

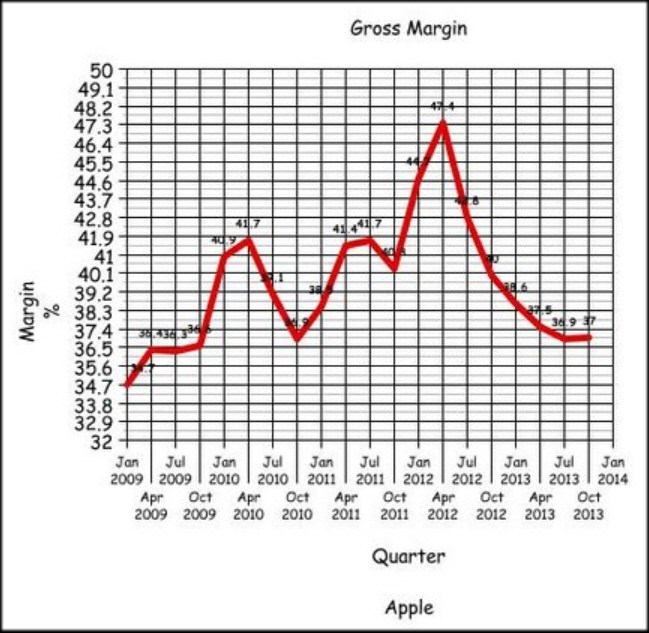

Gross margin is the one number every financial analyst looks for when it comes to Apple as it is the best means to measuring Apple's profitability for a given quarter or for an entire year. Apple had provided guidance on gross margin of between 36.5 and 37.5 percent during its last earnings call back on October 28, 2013. How did the company do? As noted above it beat its estimate by delivering 37.9 percent, but this isn't enough to say anything more than Apple hit a nice clean single. No home runs here.

It is worth noting that in the March quarter of 2012 Apple reported gross margin of 47.4 percent as the stock began its run up to $705 per share before the "great falling off" that subsequently ensued as Tim Cook took over as CEO of the company. One issue that has worried analysts has been the fact that Apple's revenue continues to rise but net income has declined. Below is a handy chart courtesy of Yahoo Finance that shows the steep drop in gross margin from 2012.

For example, for its fiscal 2013, which ended on September 28, 2013, Apple reported revenue of $170.9 billion, a solid increase over the previous year's $156.5 billion. But Apple reported net earnings of $37.04 billion for 2013, compared to net earnings of $41.73 billion in 2012. Gross margin dipped from $68.66 billion in 2012 to $64.30 billion in 2013. For analysts this marks a steep decline in profitability even though sales revenue continued to ramp up.

The consensus estimate from analysts was for net income of $12.68 billion, about 3 percent lower than a year ago. But, in fact, net income was flat year over year at $13.1 billion. Consensus revenue estimate was for $57.46 billion, which Apple just beat at $57.6 billion.

Apple provided guidance as follows for its fiscal Q2 2014:

- Revenue between $42 billion and $44 billion

- Gross margin between 37 percent and 38 percent

- Operating expenses between $4.3 billion and $4.4 billion

Guidance is certainly disappointing. More to come after the earnings call, which at 6 pm EST. As we write Apple is down to $520, $30 off its market close today, roughly 5.5 percent.

Edited by

Ryan Sartor