Facebook has just reported its financial results for both its fiscal 2013 Q4 and full year, which ended on December 31, 2013. As many of us expected, the company was able to deliver numbers that beat consensus analyst estimates, giving the stock a small boost ahead of the company's formal earnings call, taking place this evening at 5:00 pm EST. We'll report back in detail in the morning, but let's take a look at the relevant numbers here.

For the full year the relevant details are as follows:

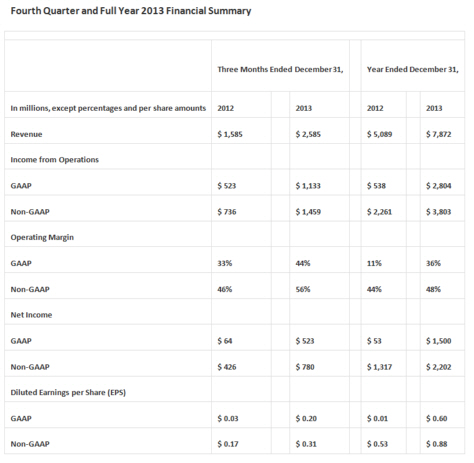

- Revenue for the full year 2013 was $7.87 billion, an increase of 55 percent year-over-year

- Income from operations for the full year 2013 was $2.80 billion

- Net income for the full year 2013 was $1.50 billion

- Free cash flow for the full year of 2013 was $2.85 billion

- Daily active users (DAUs) were 757 million on average for December 2013, an increase of 22 percent year-over-year

- Mobile DAUs were 556 million on average for December 2013, an increase of 49 percent year-over-year

- Monthly active users (MAUs) were 1.23 billion as of December 31, 2013, an increase of 16 percent year-over-year

- Mobile MAUs were 945 million as of December 31, 2013, an increase of 39 percent year-over-year

Specifically for fiscal Q4 2013 the numbers look as follows:

- Revenue for the fourth quarter of 2013 totaled $2.59 billion, an increase of 63 percent, compared with $1.59 billion in the fourth quarter of 2012.

- Revenue from advertising was $2.34 billion, a 76 percent increase from the same quarter last year

- Mobile advertising revenue represented approximately 53 percent of advertising revenue for the fourth quarter of 2013, up from approximately 23 percent of advertising revenue in the fourth quarter of 2012

- Payments and other fees revenue was $241 million for the fourth quarter of 2013

GAAP net income was $523 million - for fiscal Q4 2012 net income was only $64 million. Drilling down to the bare essentials Facebook delivers fiscal Q4 2013 earnings per share of $0.31, beating consensus analyst estimates by a solid $0.04 per share. For the same quarter total revenue was $2.58 billion, up a whopping 63.3 percent from fiscal Q4 2012. Facebook beat consensus analyst estimates by $250M.

GAAP operating margin was 44 percent for Q4 2013, significantly better than the 33 percent the company recorded in Q4 2012. For the end of the full fiscal year Facebook ended up with marketable securities of $11.45 billion - also a solid and substantial number.

There isn't much to dissect here. The numbers reflect that Facebook is both rapidly evolving and moving in the right directions. In fact the numbers demonstrate that the year's run up on the stock, from $19 per share 6 months ago to just over $56 per share as we write is entirely justifiable based on the company's financial performance.

We'll have details from the earnings call in the morning, but from what we see here it should be a generally happy call free of any hand wringing.

Edited by

Cassandra Tucker